A career in accounting can take you any number of places, depending on the path you choose. Management accounting and financial accounting are just two of the options open to you, and each role occupies a unique place in the business finance function.

If you’ve been deliberating between the two, then fear not. Our finance and accounting recruitment experts are here to share details on the distinction between financial accounting and management accounting. Learn what each role entails, which areas share overlap and what makes them different.

What's a Financial Accountant?

Financial Accountants are responsible for creating industry-standard reporting on behalf of the company they work for. They’re tasked with recording and reporting all finances so regulators, investors, and creditors can accurately assess business performance and solvency.

As a Financial Accountant, you'd be responsible for ensuring business income statements align with strict reporting standards. You’ll also act as the main point of contact for tax, pensions, auditing, and other financial issues.

“While both roles make up the pillars of accounting, there are key differences between the two that you should know before you decide which is the most suitable role for you,” says Caroline King, Director of Permanent Talent Solutions at Robert Half. “Financial accounting looks at the past and is for an external audience, whereas management accounting is based on current and future trends and is for internal use.”

Financial Accountant duties

- Act as the principal contact for tax, pension, audit issues, insurance, rates matters, and statutory returns

- Quarterly and monthly reporting

- Year-end reporting and tax pack

- Ensure all business accounts adhere to both internal and external audit requirements

- VAT returns

- Preparing balance sheet reconciliations

- Conducting internal audits

Financial Accountant skills and qualifications

- ACA, or ACCA qualification

- Experience with UK statutory reporting

- Strong skills covering both technical accounting and reporting

Search Financial Accountant roles

What's a Management Accountant?

A Management Accountant helps managers within the business make well-informed decisions by providing highly detailed reporting. Their tailored reports are created for internal use and are designed to help identify investment opportunities, plan budgets, and manage risk.

Management Accountants can work for government organisations and both private and public companies. They assist the Board of Directors and the CEO in making strategic decisions and can also be called on for business partnering duties.

“The most common route into a management accounting position is to take an entry-level role, usually as an accounts assistant, within the finance function of a company, then work your way up. This would typically involve bookkeeping and other transactional elements of accounting,” says Salima Izagaren, Business Manager at Robert Half.

“Some firms may require a degree as an entry point, but this isn’t always necessary. You can expect to work for around three to four years whilst completing the ACCA or CIMA qualification before becoming a fully-fledged management accountant. From then on, career options include working towards a Finance Manager role or opting for the forward-looking commercial finance route, which is very popular but also very competitive.”

Management Accountant duties

- Financial analysis

- Business performance reporting

- Preparing monthly accounts

- Monthly payroll preparation

- Cash flow management and forecasting

- Preparing forecasts and budgets

- Support the response to requests from senior management and other stakeholders as necessary

Management Accountant skills and qualifications

- CIMA, ACA, or ACCA qualification

- VAT, PAYE, and IFRS knowledge

- Analytical thinking skills

Search Management Accountant roles

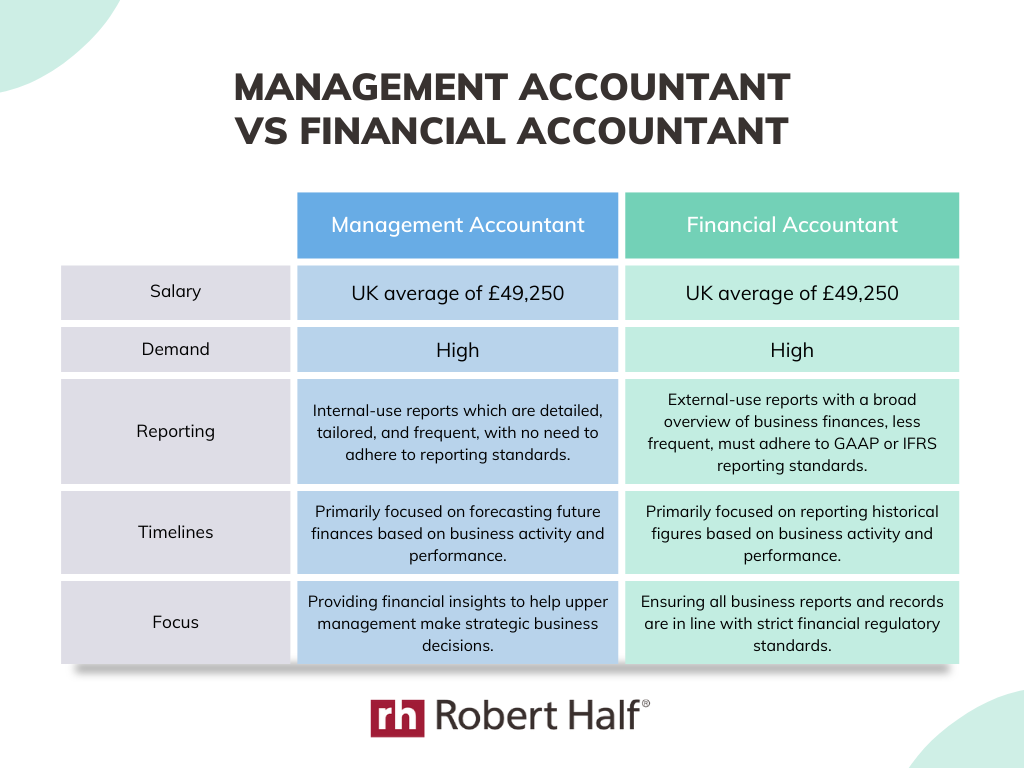

Salary

Financial Accountants and Management Accountants both have similar earning potential. In the UK, you can earn an average of £49,250 in either role, depending on your qualifications and level of experience.

Demand

According to data collected for the Robert Half 2023 Salary Guide, Financial Accountants and Management Accountants both sit within the top four in-demand roles for finance and accounting. The only difference is that the barrier to entry is lower for Management Accountants — employers are looking for assistants rather than fully qualified talent.

Reporting

Management accounting and financial accounting have very different reporting standards. Because financial accounting is focused on providing information to external parties, they must adhere to strict GAAP or IFRS reporting standards. On the other hand, Management Accountants create reports for internal use, so follow a structure outlined by the business to suit its own needs.

Management accounting narrows in on specific aspects of the business, often creating detailed reports on profits per product type, customer segment, etc. In contrast, Financial Accountants look at the business through a big-picture lens. They report on all business finances according to specified industry timelines.

Timelines

Management Accountants use past data to guide strategic business decisions and forecast the future. Alternatively, Financial Accountants are responsible for reporting on past financial periods.

Focus

Management Accountants are more focused on using the business’ financial data to forecast and budget for the future. They use their knowledge to help guide upper management with decision-making and strategy.

Financial Accountants support the business by creating impeccable reports and financial records to accurately depict business performance and financial solvency. They keep business finances up to industry standards and ensure they’re audit-ready.

Find your next accounting career opportunity today. Upload your CV to the Robert Half website or browse open job roles for management accounting and financial accounting now.

Find out more about the finance and accounting hiring landscape by downloading the 2023 Salary Guide for free.

%20(12).png:Large-1x?fmt=webp-alpha)